Income tax calculation can be a daunting task, especially when dealing with complex financial situations. However, utilizing tools like Microsoft Excel can simplify the process and streamline accuracy. In this article, we’ll explore the steps to create an income tax calculation formula in Excel, along with useful tips and examples.

Introduction to Income Tax Calculation Formula in Excel

Income Tax Calculation Formula in Excel is a crucial aspect of personal finance, as it ensures citizens contribute to government revenue based on their earnings. Understanding how to calculate income tax accurately is essential for financial planning and compliance with tax laws.

Understanding Excel for Tax Calculation

Excel is a versatile spreadsheet program that offers powerful tools for data analysis and calculation. Before diving into tax calculations, it’s important to grasp the basics of Excel and familiarize oneself with relevant functions such as SUM, IF, and VLOOKUP.

Steps to Create Income Tax Calculation Formula in Excel

✯ Gathering Necessary Information

Before creating the tax calculation formula, gather all relevant financial information including income sources, deductions, and credits.

✯ Setting Up Excel Sheet

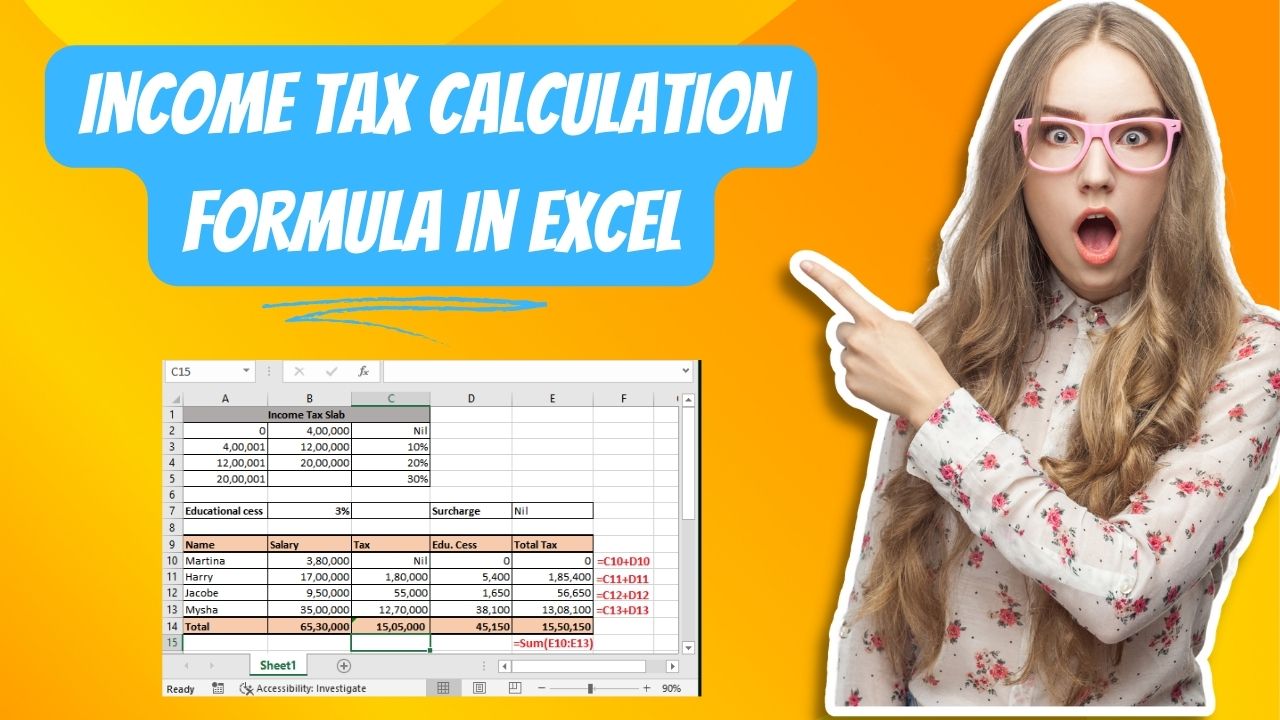

Create a new Excel worksheet and organize data into relevant categories such as income, deductions, and credits.

✯ Inputting Tax Data

Enter income figures and applicable deductions into designated cells on the Excel sheet.

✯ Calculating Taxable Income

Utilize Excel functions to calculate taxable income by subtracting deductions from total income.

✯ Applying Tax Rates

Determine the appropriate tax rates based on taxable income and apply them using Excel formulas.

✯ Deducting Tax Credits

Account for any tax credits or deductions for which you qualify, reducing the final tax liability.

Examples of Income Tax Calculation Formula in Excel

Example 1: Single Individual with Fixed Income

In this scenario, let’s consider John, who is employed and receives a fixed salary each month. To calculate his income tax using Excel, we’ll follow these steps:

1. Gather Information: Collect John’s income details, including his salary, any additional income sources, and relevant deductions such as contributions to retirement accounts or mortgage interest.

2. Set Up Excel Sheet: Create a new Excel worksheet and label columns for income, deductions, and tax calculations.

3. Input Data: Enter John’s salary and deductions into the appropriate cells on the Excel sheet.

4. Calculate Taxable Income: Utilize Excel formulas to subtract deductions from total income, yielding John’s taxable income.

5. Apply Tax Rates: Determine the tax rates applicable to John’s taxable income based on the current tax laws. Use Excel functions to apply these rates and calculate his tax liability.

6. Deduct Tax Credits: If John qualifies for any tax credits, incorporate them into the Excel formula to reduce his final tax liability.

Example 2: Self-Employed Individual with Variable Income

Now, let’s consider Sarah, who is self-employed and earns variable income throughout the year. Since self-employed individuals don’t have taxes withheld from their paychecks, they are responsible for calculating and paying taxes on their own. Here’s how we can use Excel to assist Sarah in calculating her income tax:

1. Gather Information: Collect Sarah’s income details, including earnings from her business, any expenses eligible for deductions, and potential tax credits.

2. Set Up Excel Sheet: Similar to the previous example, create an Excel worksheet with columns for income, expenses, deductions, and tax calculations.

3. Input Data: Enter Sarah’s business income and deductible expenses into the appropriate cells on the Excel sheet.

4. Calculate Taxable Income: Use Excel formulas to subtract Sarah’s business expenses from her total income, determining her taxable income.

5. Apply Tax Rates: Based on Sarah’s taxable income, apply the relevant tax rates using Excel functions to calculate her tax liability.

6. Consider Quarterly Payments: Since self-employed individuals typically make quarterly estimated tax payments, Sarah may need to adjust her Excel calculations accordingly to ensure compliance with tax requirements.

Also Read: Jeffrey Dahmer Crime Scene: A Detailed Investigation

Tips for Efficient Income Tax Calculation Formula in Excel

- Keep formulas organized and clearly labeled for easy reference.

- Double-check input data and formulas to ensure accuracy.

- Utilize Excel’s auditing tools to troubleshoot errors.

- Regularly update Income Tax Calculation Formula in Excel to reflect changes in tax laws.

Common Mistakes to Avoid

- Overlooking eligible deductions and credits.

- Incorrectly inputting data or formulas.

- Failing to account for changes in tax laws.

- Neglecting to save backups of Excel files for future reference.

Benefits of Using Excel for Tax Calculation

- Streamlines the tax calculation process.

- Provides flexibility to customize formulas based on individual circumstances.

- Offers built-in tools for data analysis and visualization.

- Facilitates collaboration and sharing of tax information.

Conclusion

Mastering Income Tax Calculation Formula in Excel can enhance financial literacy and empower individuals to make informed decisions regarding their taxes. By following the steps outlined in this article and utilizing Excel’s features effectively, taxpayers can navigate the complexities of tax calculation with confidence.

FAQs

Q: Can Excel handle complex tax calculations involving multiple income sources?

A: Yes, Excel can accommodate complex tax scenarios by utilizing advanced functions and formulas to calculate taxable income and apply relevant tax rates.

Q: Is it necessary to update tax calculation formulas annually?

A: It’s advisable to review and update tax calculation formulas annually to account for changes in tax laws and personal financial circumstances.

Q: Can Excel automatically calculate tax liabilities based on user input?

A: Yes, Excel can be programmed to dynamically calculate tax liabilities based on user input, providing real-time results for various financial scenarios.

Q: Are there any Excel templates available for income tax calculation?

A: Yes, there are numerous Excel templates and spreadsheets available online specifically designed for income tax calculation, catering to different tax scenarios and requirements.

Q: How can I learn more about advanced Excel functions for tax calculation?

A: There are plenty of online resources, tutorials, and courses available that focus on advanced Excel functions for tax calculation, catering to users of all skill levels.